The government through the Ghana Revenue Authority (GRA) recently announced new compliance measures targeting the foreign incomes of resident Ghanaians as a replacement for the suspended 18 percent Value Added Tax (VAT) on electricity.

The GRA explained that the rigorous implementation of the foreign income tax would be a credible replacement for the VAT on electricity which was flatly rejected by Ghanaians and is projected to raise about GH¢1.8 billion in revenue.

Following the announcement, the government has given resident Ghanaians three months from May 1, 2024, to voluntarily declare their foreign income in order to benefit from a waiver on the interest on their account.

Now what is this foreign income tax about and which category of Ghanaians would be affected?

About the ‘Foreign Income Tax’

First of all, the foreign income tax is not a new tax measure. It is not known by many Ghanaians because successive governments have relaxed on its rigorous implementation.

The tax was introduced in 2015 in the Income Tax Act (Act 896) and it seeks to tax incomes Ghanaians earn from abroad.

The GRA defines foreign income as “income you receive for services you perform in a foreign country in a period during which your tax home is in a foreign country and you meet either the required residence test or the physical presence test”. That is the income a Ghanaian earns for services while living and working in a foreign country.

According to the act, “The foreign income of a resident person is taxable except, where the employment income of the resident individual is from a foreign source and derived from a non-resident employer”.

Another category of Ghanaian residents who would not attract the foreign income tax is “where a resident person is an employer and the individual is present in a foreign country for at least one hundred and eighty-three (183) days continuous”.

George Ankomah, a senior tax partner at Deloitte, in an interview with JoyNews, explained that Ghana’s foreign income tax “has to do with Ghanaians who have incomes that are earned outside Ghana and the requirements under the income tax law which was passed way back in 2015, is that once you are a resident of Ghana, your global income is taxable in Ghana”.

He also noted that Ghanaians earning foreign income would not be obliged to pay the foreign income tax if the declaration of their income reveals that they pay more taxes in the countries they work in than the tax they are to pay in Ghana.

What the Foreign Income Tax covers:

Now let us take a look at the types of foreign income of resident Ghanaians which would attract the tax.

According to PwC Ghana, resident Ghanaians are taxed on their worldwide income, including their foreign income gained from:

1. Remuneration from any employment, including salaries, allowances and other benefits.

2. Gains or profits from trade, business, profession, or vocation.

3. Gains from realization of assets and liabilities.

4. Gifts.

5. Dividends.

6. Any charge or annuity.

7. Royalties, premiums, and any other profits arising from property.

8. Receipts, including royalties or periodic or deferred payments, of any kind derived from any transaction wherever and whenever made, affecting directly or indirectly, and/or from any natural resources in Ghana, and notwithstanding whether the receipts are paid within or outside Ghana.

How much foreign income you would be taxed depending on your income:

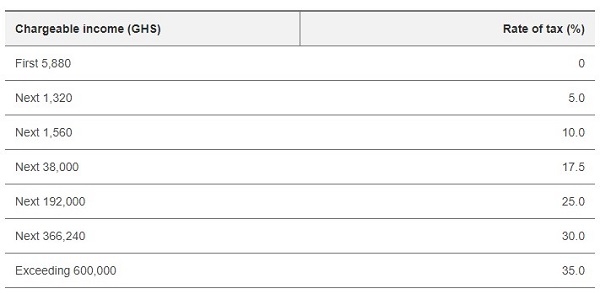

According to PwC Ghana, residents Ghanaians are subject to graduated personal tax rates with rates ranging from 0% to 35%. Annual income up to GH¢ 5,880 is taxed at 0%. Any income in excess of GH¢ 600,000 is taxed at 35%.

Below is a schedule of taxes provided by PwC:

Nonresident individuals pay taxes on their employment income at a rate of 25%.

Benefits of paying foreign income tax:

Another thing not known to most Ghanaians is that taxpayers, including those who pay foreign income tax, are eligible for tax credits – foreign tax credit.

The tax law states, “A resident person other than a partnership may claim a foreign tax credit in respect of tax paid to a foreign country. A person may relinquish a foreign tax credit and claim it as a deduction”.

BAI/NOQ