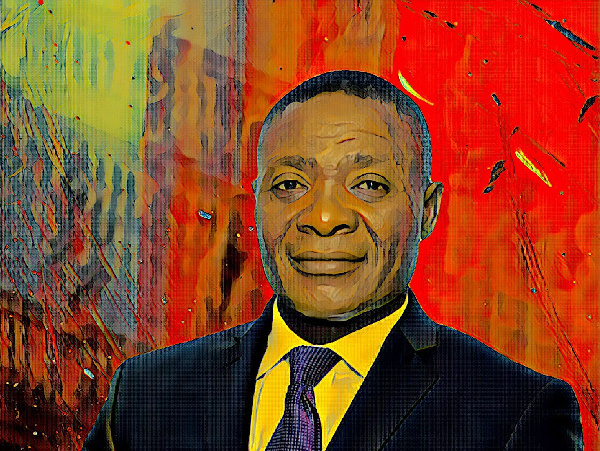

Ghanaian businessman and serial investor Daniel Ofori has experienced a considerable drop in his net worth due to a decline in the market value of his stake in Societe Generale Ghana, an Accra-based bank.

According to data tracked by Billionaires.Africa, Ofori’s stake in Societe Generale Ghana has decreased by over $1.5 million since the start of the year. This decline is attributed to the sustained drop in the bank’s share price and the depreciation of the Ghanaian cedi.

Societe Generale Ghana, the fourth-largest bank in Ghana, operates as a subsidiary of the renowned French multinational investment bank, Societe Generale, which is headquartered in Paris. With a network of approximately 45 branches spread across Ghana, the bank is one of 17 subsidiaries of its parent company in Africa.

READ MORE: Check Out What Will Happen To Your Body If You Eat Banana

As of the report’s drafting, the bank’s shares were trading at GH¢0.90 ($0.071), leading to a market capitalization of GH¢638 million ($50.4 million) for the Accra-based financial services provider.

Ofori, a renowned Ghanaian businessman and the wealthiest investor on the Ghana Stock Exchange, holds a significant ownership stake of 6.8 percent in Societe Generale Ghana, or 48,241,241 shares, thereby making him the largest individual shareholder in the bank.

Data compiled by Billionaires.Africa revealed that the market value of his stake in the bank has decreased from GH₵48.24 million ($4.94 million) on Jan. 1 to GH¢43.41 million ($3.43 million) at present.

The decline is mainly attributed to the depreciation of the Ghanaian cedi and the fall in the bank’s share price. Despite the drop in his wealth by $1.5 million, Ofori still retains his position as the richest investor on the Ghana Stock Exchange.

This is due to his well-diversified investment portfolio, which comprises holdings in various companies, including GCB Bank, Fan Milk Plc, CAL Bank, and Societe Generale Ghana.

Source: Ghanaweb.com